Property valuation services

Experienced, certified, registered and independent property valuers in Brisbane. For expert property valuations and advice on the following real estate valuation requirements in Queensland we can help. An overview of our property valuation services below:

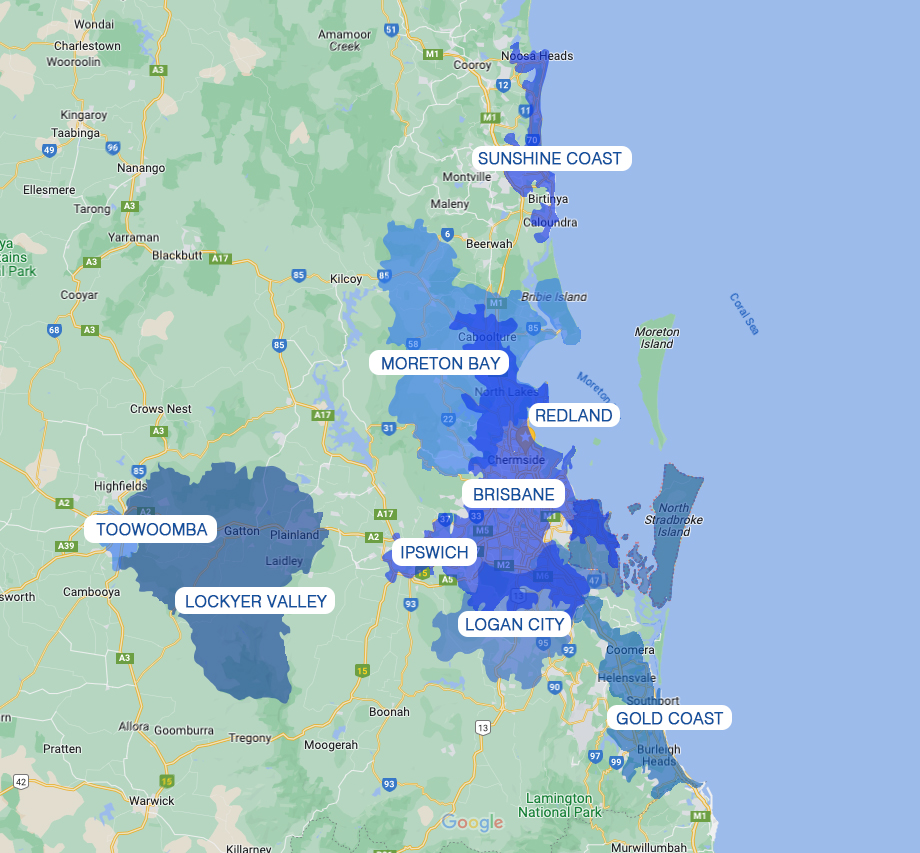

The CSA Valuers service covers property in most areas in Queensland including but not limited to Brisbane. Property valuations in Ipswich, Toowoomba, Logan, Redland, Gold Coast, and Sunshine Coast. Request a quote and find out more about our property valuation report format and the cost of a property valuation.

Valuation Quote

Mortgage Security

Property valuations for mortgage security are required by lending institutions on behalf of the purchaser to determine the amount of finance required for the purchase of a particular property. The majority of financial institutions have a set panel of valuers from whom they accept valuations. If a property valuation is required for a particular institution, please check with us that the valuation report can be utilised by that institution. Alternatively you may need a valuation for your own purposes to determine the level of equity you have in the property.

Pre-sale and Pre-purchase Advice

A pre-sale or pre-purchase valuation gives the vendor or potential purchaser a powerful tool to take to the negotiating table. A current valuation report is widely regarded the most credible source of information available. It will assist a vendor to determine a reserve sale price, or help a purchaser identify their highest price limit, or offer on a property for sale. A valuation report, which costs only a few hundred dollars, can potentially save tens of thousands.

Capital Gains Tax

Capital gains tax applies to all investment properties purchased in Australia after September 1985. It is a tax charged on the sale of an asset, such as real estate, when it is sold for more than its previous purchase price. Real estate investors need to calculate the increase in property value over a holding period to determine the capital gains tax payable at the time of sale. A current or retrospective valuation will identify the actual increase in a property’s value. More info on the capital gains tax valuation here.

Transfer Duty (Stamp Duty)

Transfer Duty in Queensland (previously called Stamp Duty) and is the tax paid on the transfer of an asset, such as real estate, between two parties. Getting a property valuation for this purpose is generally carried out where there is a relationship between the two parties (such as sale between parents to children) and the sale is deemed to be not at arm’s length. The valuation will provide the correct figure on which the duty will be assessed. If you are interested read our more detailed guide on valuations for stamp duty / transfer duty.

Deceased Estates Property Valuations

Valuations for deceased estates are used to determine the asset value of a particular estate. Having a valuation carried out on properties forming part of the estate can help executors and beneficiaries appropriately administer the estate and minimise the possibility of dispute.

Property Resumption / Compensation

Where a property has been resumed or compulsorily acquired, a valuation is required to determine the full amount of compensation due to the owner. In some cases, the land taken is either a full take (where the whole property is resumed / acquired) or a partial take (where only part of the property is taken i.e. for road widening purposes). In these cases, all valuation fees are paid or reimbursed by the constructing / resuming authority.

Insurance Valuations

An insurance valuation is carried out to determine the correct amount of insurance cover required for structures including residential dwellings, industrial / commercial buildings, and retail premises. The assessment takes into consideration the size (m²) and nature of the improvements and current demolition and constructions costs.

Insurance Advice Reports

For bodies corporate, insurance advice reports are necessary to determine the correct level of insurance cover required for all buildings and common property forming part of a particular scheme. The assessment takes into consideration the type of construction of the buildings (residential/commercial/industrial/retail), individual lots sizes, demolition costs, construction costs, consultants fees, cost escalation and GST. The assessment also includes a percentage of the overall scheme for each individual unit.

Family Law Valuations

Property valuations for family law matters are carried out where there is a separation of two parties through divorce / breakdown of a marriage / de facto arrangement. The valuation can help to dissolve any disputes which may arise regarding the current value of the property. In some cases, both parties may elect to jointly instruct a single valuer to act on their behalf. Alternatively, each party may independently instruct a valuer to act solely for them. For more information regarding valuations for separation settlement visit our divorce settlement valuations page.

Inspections for Progress Payments

Where a building is being constructed such as a residential house or home units, or a commercial building, and the project is being financed by a lending institution, inspections for progress payments will be required to confirm that the amount of work carried out for each stage of construction has been completed.

Frequently Asked Questions

Do Clem Scanlan & Associates have any affiliations with real estate agents or property developers?

No, we are an independent valuation practice, governed by the Australian Property Institute and Valuers Registration Board of Queensland. Whilst we can provide valuations for real estate agents and developers, we have no affiliation with them.

Is a valuation the same as an agent’s appraisal?

No, an appraisal is done by a real estate agent, not a registered valuer. Real estate agents are also not legally accountable for their appraisal. A person registered as a valuer by The Valuers Registration Board of Queensland may prepare a formal valuation of a property in Queensland should they have the appropriate industry experience and hold the required tertiary qualifications.

What is involved in preparing a valuation?

The valuer will make an inspection time with the person nominated by the instructing party, conduct sales searches and consult with the governing local authority to understand the property’s zoning classification and land use options. While on site the valuer will study the inside and outside of the dwelling/buildings and take external measurements should no floor plans be available.

Does the valuer have to look inside the property?

Yes – property valuers need to look inside to see the quality and functionality of the property, how many bedrooms, bathrooms and other rooms the property has, and observe any noticeable building defects (NOTE: the valuer is not a structural engineer / building certifier). Also – professional indemnity insurance requires that we inspect internally.

How long does a property valuation take?

A land and house valuation involve an inspection of the property and an analysis of sales once back in the office. Generally, the inspection takes between 20 and 30 minutes, depending on the size of the property. The sales analysis can take anywhere between 30 minutes to several hours, depending on the complexity of the valuation.

What locations in Queensland do you serve?

CSA Valuers are licensed to provide valuations in all of Queensland. We are often doing valuations in the following areas: Brisbane Northside, Southside and Western Suburbs Brisbane. Gold Coast property valuations (including commercial and residential property valuations. We report on property values for Queensland including Brisbane, property valuations in Ipswich, Logan, Redland, Gold Coast, Moreton Bay, Lockyer Valley, Toowoomba, Sunshine Coast.

What factors influence the valuation?

Many factors can influence a property’s value. These include:

- Property age and condition of improvements, functionality, building size, land size, zoning classification, easements and encumbrances

- Location factors – suburb name, views, position in street, neighbouring properties, proximity to public transport and shops

- Economic factors – interest rates, Australian and global economic conditions

Peace of mind comes from expert advice.